Big Money Merchants Buy Meat Dip

Chain data show that big Ethereum investors have recently added to their presence, which can rise for ETH price.

Ethereum Big Owners Netflow has been positive lately

New post In X, the market intelligence platform Intothheblock spoke about the trend in Netflow, the great owners for Ethereum. This metric measures the net amount of the crypto currency moving into or out of the wallets controlled by large holders.

Analytics defines three categories for investors: retail, investors and whales. Retail sales members have less than 0.1% of the supply, 0.1% to 1% of investors and more than 1% of whales.

In the current exchange rate, 0.1% of ETH supply, which is the deduction between retail and investors, is a very important amount of over 214 million dollars. This means that the addresses that can be entitled to investors and those who have reached the whales are already quite large.

Therefore, the great owners who are interested in the current discussion include both of these groups. Thus, large owners follow the procedures related to Netflow, investors and whales.

When the value of this metropolitan is positive, it means that big money investors on the network receive a clear number of deposits to their wallets. On the other hand, being under the zero sign indicates that these lock holders participate in net sales.

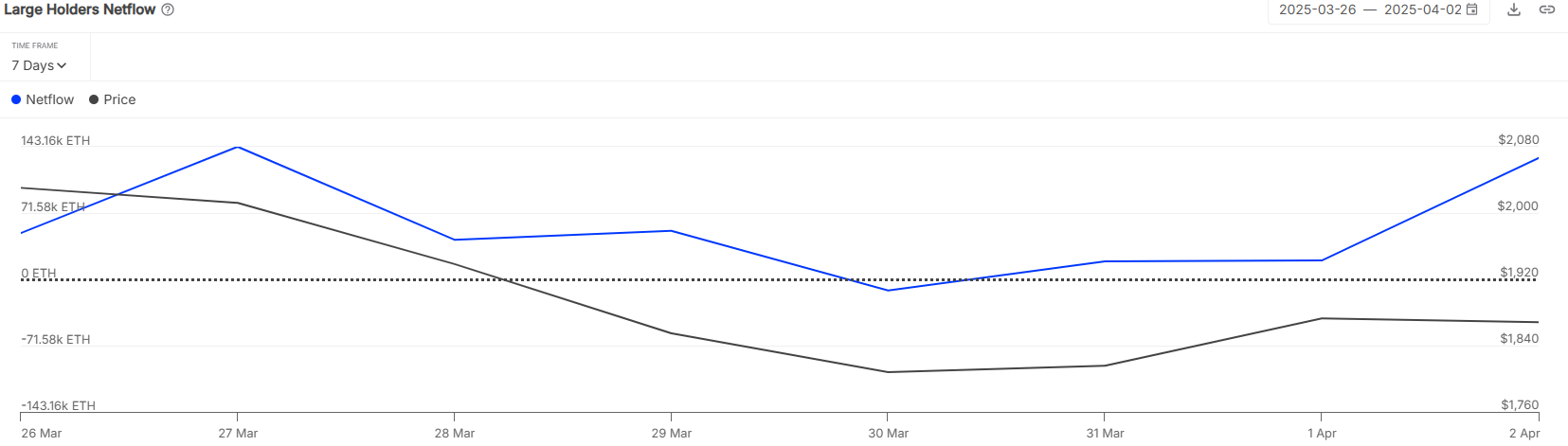

Now, last week, the graphical shared by Intotheblock showing the tendency of Ethereum great owners Netflow:

The value of the metric appears to have been positive in recent days | Source: IntoTheBlock on X

As can be seen above, Netflow, the major owners of Ethereum, remained almost completely in the positive area during the graphic period, implying that investors and whales have accumulated. Only in the second month, these key assets were installed on net 130,000 ETH (about $ 230 million).

While the crypto currency decreased, net entries came for large owners, so it is possible to believe that the latest prices offer a profitable introduction to the existence. Now it is seen whether this accumulation will be enough to help you reach a bottom.

In some other reports, Ethereum fee has fell to the lowest level since 2020 since the Analytics company pointed to another X. post.

The changes that occurred in key ETH metrics during the first quarter of 2025 | Source: IntoTheBlock on X

Following a sharp decrease of 59.6 %, Ethereum total trading fees fell to $ 208 million. According to Intothheboblock, this tendency is directed by “first gas limit increase and transactions moved to L2S”.

Meat price

Ethereum received more than $ 1,900 at the beginning of the week, but it seems to be exhausted as the Momentum returned to $ 1,770.

Looks like the price of the coin has plunged recently | Source: ETHUSDT on TradingView

The picture that stands out from DALL-E, Intotheboblock.com is graphics from tradingView.com

Editorial process Bitcoinist has been thoroughly investigated and focused on providing accurate and impartial content. We maintain solid welding standards and each page is subject to an diligent examination by our best technology experts and experienced editors team. This process provides the integrity, relevance and value of our content for our readers.