Bitcoin (BTC) will be lifted in June, analyst Pins market target is 175,000 dollars

Since it reached its highest level of all time in January, Bitcoin (BTC) has fought to create an ascension form that resulted in a downward trend in the last two months. According to well -known market analyst Ekrag Crypto, the leading crypto currency may remain in the correction for a few months before starting a price rally.

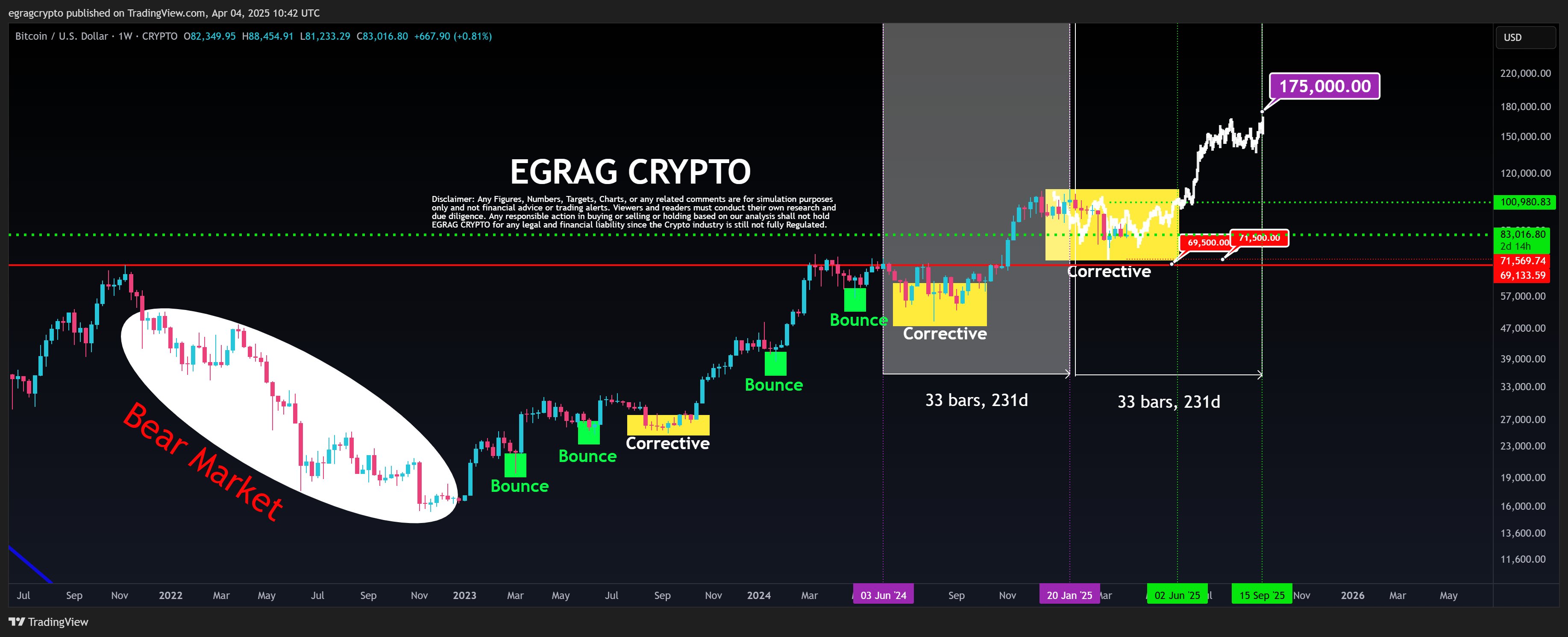

Bitcoin’s 231 -day cycle points to a target of $ 175,000 until September

After the first price decrease in February default Bitcoin may experience a price correction due to a CME gap before you have a price splashing. However, the lack of strong rise convictions in recent weeks has concluded that the leading crypto currency has potentially stuck in a long corrective stage.

According to Ekrag Last articleBitcoin’s ongoing correction is aligned with a fractal pattern, that is, a recurrent price structure that occurs in multiple time periods. This model is based on a 33 bars (231 days) cycle where BTC is a corrective phase of the explosive price rally.

While comparing previous cycles with the existing cycles, Ekrag estimated that Bitcoin could potentially re -caliber until June. In this case, the analyst expects the crypto market leader to reach a $ 175,000 market by September and earns 107.83% in existing market prices.

However, while holding this price rally, market bulls should provide a $ 100,000 rupture over the hard price barrier. On the other hand, any potential decrease that falls below $ 69,500 -71.500 $ support price level may invalidate this existing bull installation and possibly indicate the end of the current bull work.

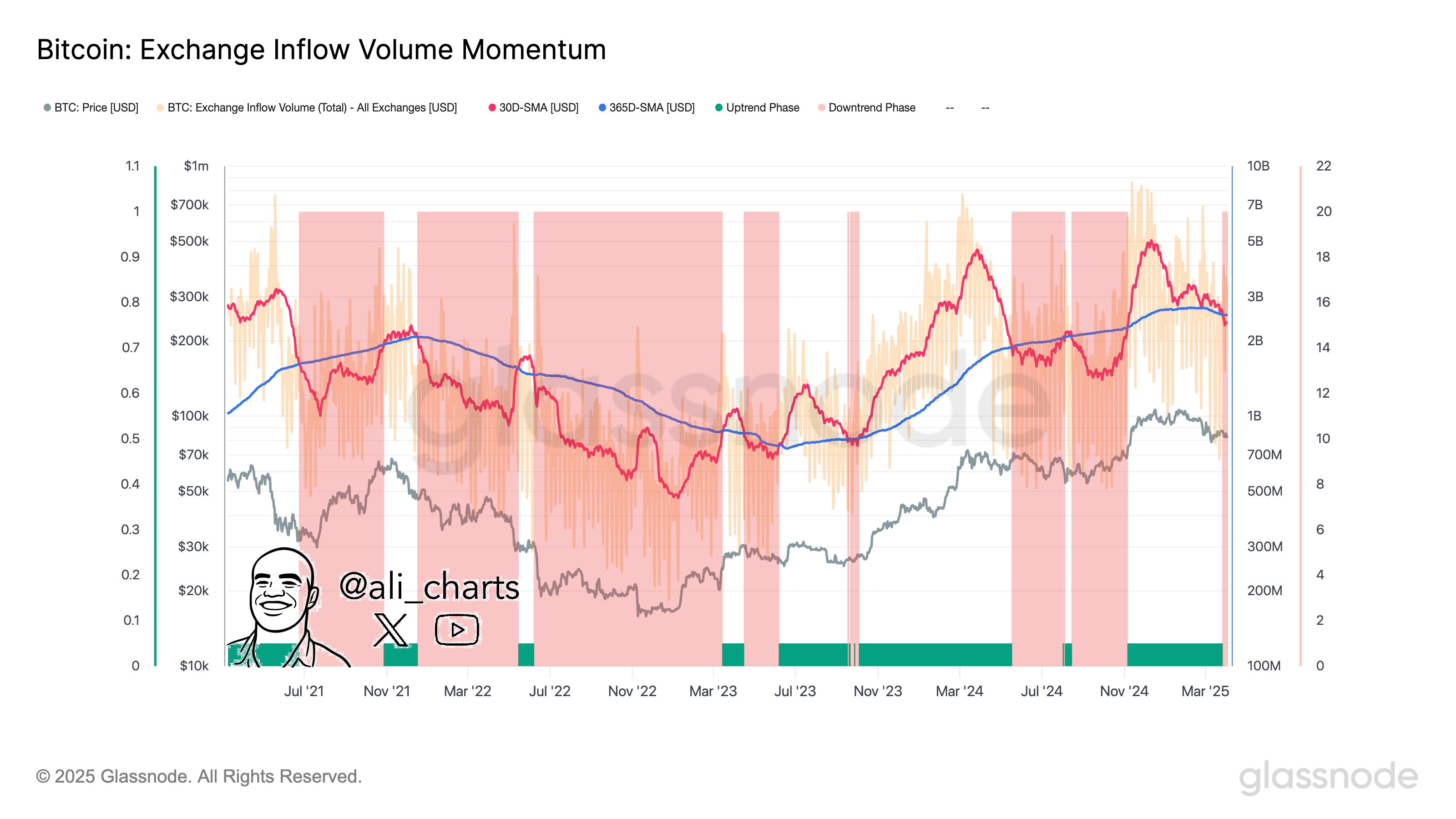

BTC investors are waiting as change activity slows down

On the other hand, popular crypto expert Ali Martinez reported A decrease in the activity of Bitcoin exchange, which shows that it reduces the interest and network use of investors. In particular, this development shows that investors hesitate to invest or withdraw Bitcoin in the stock market due to the market uncertainty in the future orbit of the presence.

According to Martinez, investors are likely to change a trend while waiting for the next market catalyst. In particular, Bitcoin has shown praised flexibility despite the new tariffs implemented by the US government on April 2. Data from centimeterThe price of the BTC fell only 4% in the hours following the announcement-a lighter reaction compared to the previous tariff-related market movements.

Since then, the BTC has made some price gains when flocked to the crypto market, which has been recorded in the crypto market where $ 5.16 billion inputs have been traded at $ 83.805. Meanwhile, BTC’s transaction volume increased by 26.52% and worth 43.48 billion dollars.

UF News, TradingView The prominent picture from graphics

Editorial process Bitcoinist has been thoroughly investigated and focused on providing accurate and impartial content. We maintain solid welding standards and each page is subject to an diligent examination by our best technology experts and experienced editors team. This process provides the integrity, relevance and value of our content for our readers.