Bitcoin bull cycle is over? This analyst thinks differently

CEO Cryptoquant at the Zincir On Analytics company declared the end of Bitcoin Bull Cycle, but it provided an analyst counterpoint.

The cover made can provide clues about what is happening for Bitcoin

One post In X, Cryptoquant founder and CEO, CEO, Young Ju explained why the bull cycle will end for Bitcoin based on the data of the cover. The ıl Cover ”refers to a chain capitalization model that assumes the real value of any coin in circulation.

The final trading price of any coin is nothing, but the price in which the investor purchases it, so the boundary that takes place measures the sum of the cost foundation of all circulating money. In other words, the model represents the amount of capital in which the owners invest in the crypto currency as a whole.

Unlike this model, the market value summarizes the supply at the current spot price shows the value that investors hold today.

When investors purchase money, the cover made rises to the definitive amount as they purchased. However, the same does not apply to market value. Depending on various market conditions, an increase in the covering cover may trigger a smaller, larger or even more equal -scale increase on the market limit.

According to the founder of the cryptocant, which of the ways in which the market value reacts to the changes in the cover can provide rise or decrease signals for BTC.

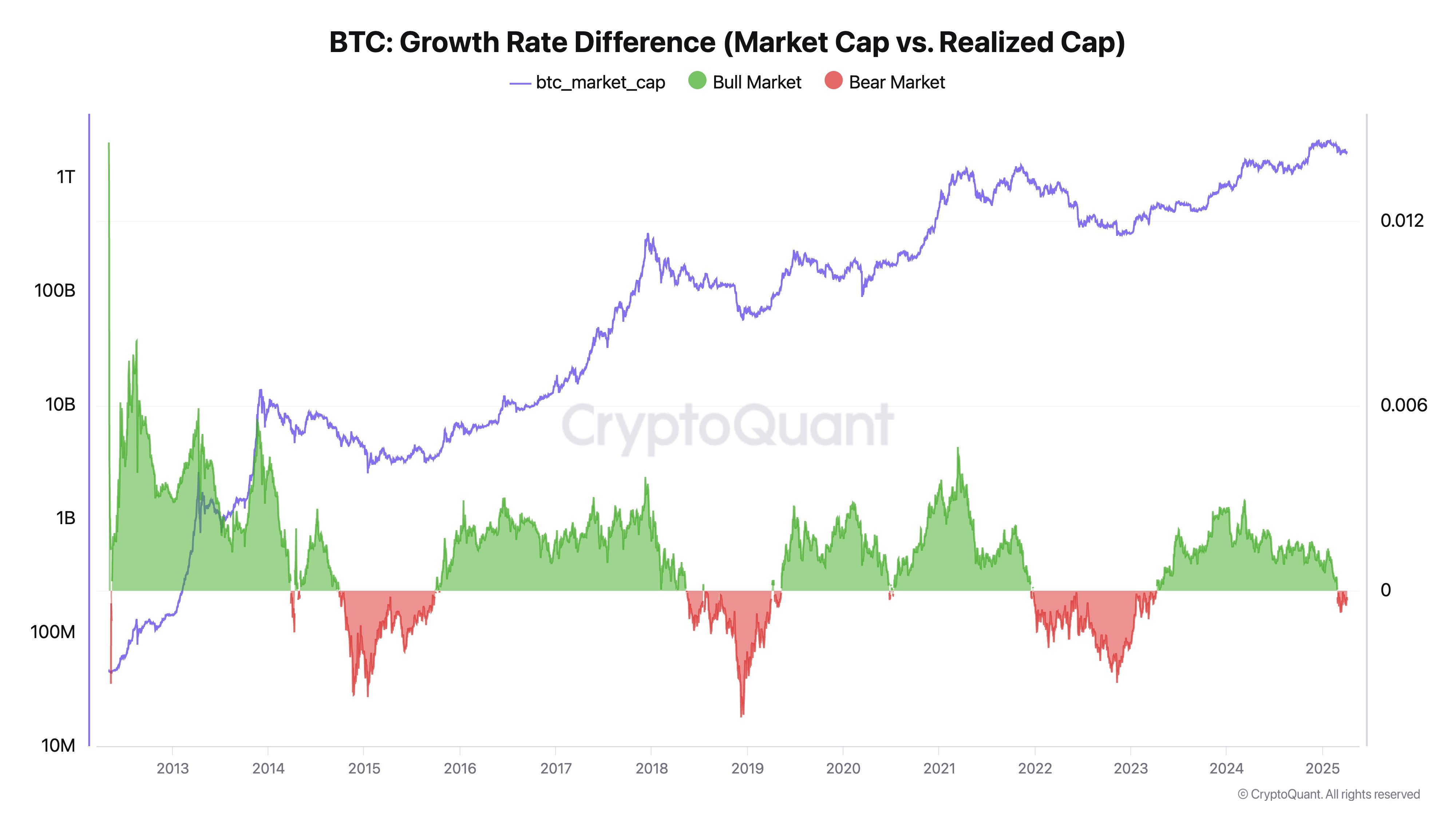

The difference between the growths in the BTC Market Cap and Realized Cap | Source: @ki_young_ju on X

From the above graph, it is seen that the difference in growth rate between the market value and the limit realized is negative recently. This means that capital inputs cannot increase the price, which is historically a signal that corresponds to periods of decline for Bitcoin.

Although this argues that the bull market may end, another analyst James van Straten provided a different perspective in an X post. Here is the graph that the analyst against Young Ju shows the trend on the BTC cover as well as the percentage of disadvantage over the past of the coin:

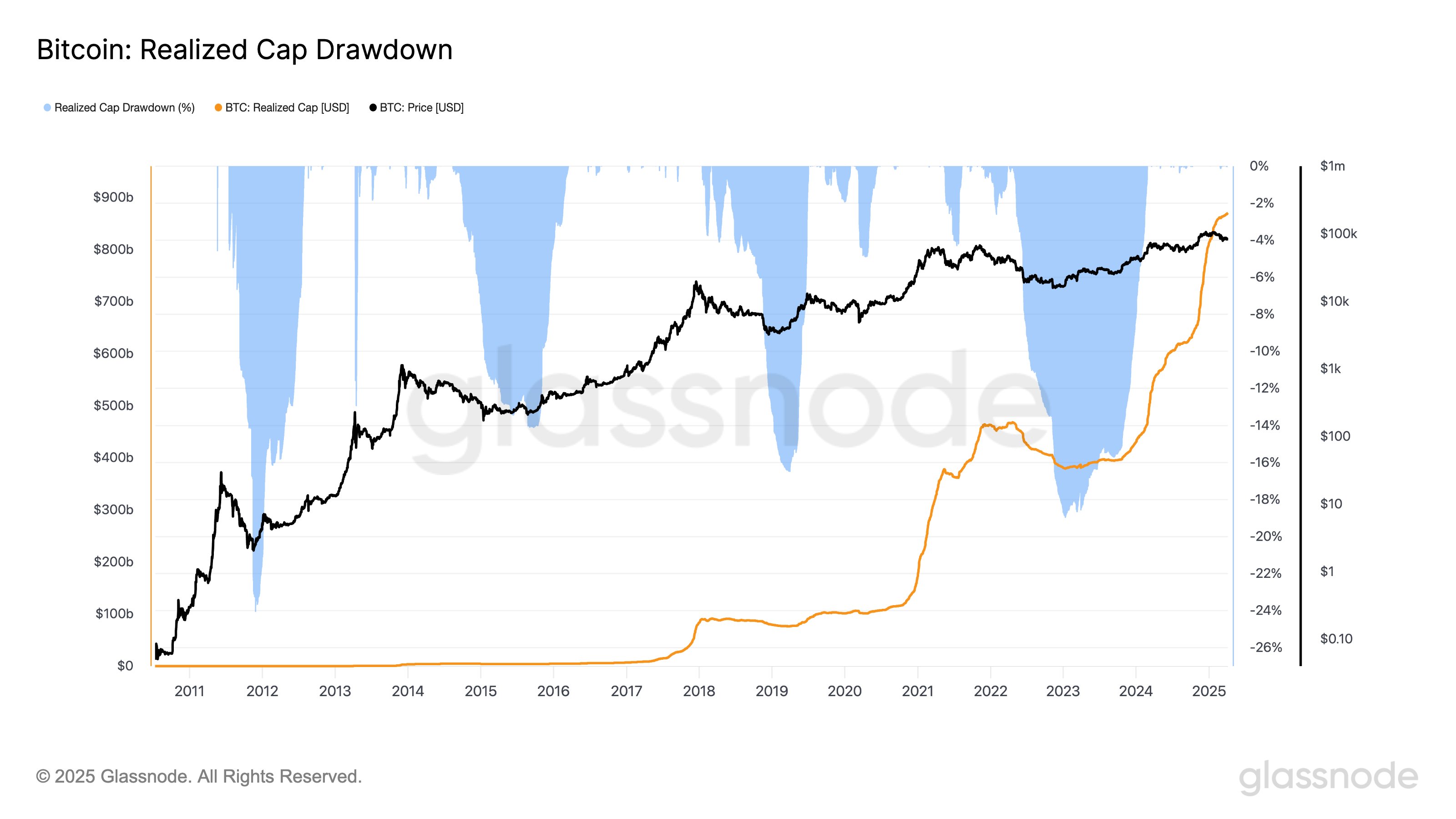

The Realized Cap has continued to climb up in recent days | Source: @btcjvs on X

As in the graph, the border witnessed a historically strong lottery during the bear markets. This happens as a result of the surrender of investors at lower prices than they purchased and thus reduces the supply.

So far, the cover has not seen a major disadvantage, although the price has recently fallen. This will imply that investors still trust Bitcoin to some extent. Not only that, but the cover has actually maintained its orbit recently, which is a sign that capital inflows do not allow.

Van Straten, “bear markets often do not start with confidence and entrances,” he says. Time could only answer whether the BTC had passed to a bear.

BTC price

Bitcoin launched the new week with an accident almost 7%, which reduced its price to $ 76,500.

Looks like the price of the coin has plunged over the past day | Source: BTCUSDT on TradingView

DALL-E, Cryptoquant.com, featured image from Glassnode.com, graphics from tradingView.com

Editorial process Bitcoinist has been thoroughly investigated and focused on providing accurate and impartial content. We maintain solid welding standards and each page is subject to an diligent examination by our best technology experts and experienced editors team. This process provides the integrity, relevance and value of our content for our readers.