Bitcoin retail panic sale – Mega whales while buying the wave

Data in the chain show that small Bitcoin owners have recently deepened their sales and increases the purchase of the largest investors.

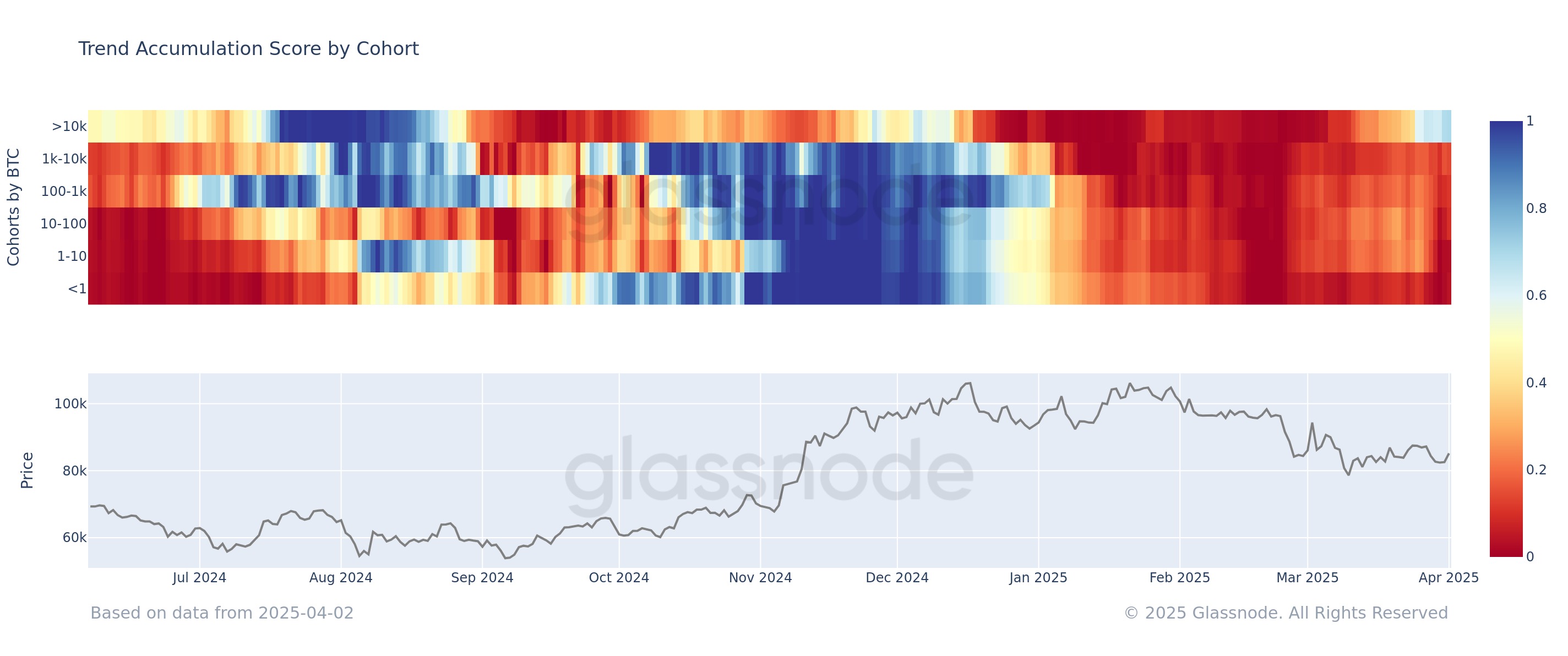

Bitcoin accumulation trend score, Iraqs between owners occurs

New post In X, the chain analytical company Glassnode discussed the latest trend in the trend score for the various Bitcoin holder cohort.

The accumulation tendency score is a indication of whether BTC investors have accumulated or distributed. The indicator calculates its value not only by following the balance changes in the wallets of investors, but also by taking into account the size of the addresses.

When the value of the metropolitan is more than 0.5, it shows that large investors (or alternatively small investors) purchase. The closer the indicator 1 sign, the stronger this behavior is.

On the other hand, the score is less than 0.5 means that the market passes through a potential distribution phase. In this case, the excessive dot lies at zero value.

In the context of the current subject, the version of the interesting accumulation trend score is not for the United Network, but the version of the behavior for various investor groups separately.

Addresses or owners are reserved for these cohort on the basis of the wallet size. How has the accumulation tendency score changed for each group last year:

Looks like most of the market is currently in a phase of distribution | Source: Glassnode on X

As shown in the graph above, the Bitcoin accumulation trend score saw a value close to 1 level for most of the investor groups between November and January, which implied that strong accumulation occurred. In addition to this purchase, the BTC enjoyed the bull run beyond a $ 100,000 level.

However, with the beginning of this year, the indicator achieved a value of nearly zero value for all cohorts in February and the transition to sale took place. Naturally, the crypto currency was reversed as a result of this distribution.

March saw that investors have retreated to their sales, but the net situation in the sector remained strictly remained strictly. From the graph, it can be seen that the owner’s behavior has been almost uniform for most of the year, but recently a difference has become apparent.

Popularly known as retail investors, owners, less than 1 BTC, fell below Metric 0.2 and deepened their distribution again. On the other hand, investors at the opposite end of the spectrum, the largest assets of more than 10,000 BTC, focused on accumulation by approaching the score 0.6.

When the bull pressure began to allow Bitcoin earlier, these ‘Mega Whales’ were the first to participate in a strong sale. This smart money cohort is now possible to lead another trend change for being, as it does something different from the rest of the market once again.

BTC price

Bitcoin was opened with some improvement in April because its price rose to $ 84,900.

The price of the coin has been stuck in consolidation lately | Source: BTCUSDT on TradingView.com

DALL-E, featured picture from gllassnode.com, graphics from tradingView.com

Editorial process Bitcoinist has been thoroughly investigated and focused on providing accurate and impartial content. We maintain solid welding standards and each page is subject to an diligent examination by our best technology experts and experienced editors team. This process provides the integrity, relevance and value of our content for our readers.