Ethereum (ETH) Time to Purchase? Here is what this analyst thinks

Ethereum (ETH) recorded some small gains last week and increased by 2.80%. However, the leading Altcoin is far from getting rid of a downward trend that extends back to December. In the midst of this decline, the famous market analyst Ali Martinez emphasized the critical price levels in deciding whether the correction of ETH is finished and whether it is suitable for entry to the market.

Ethereum: Is it a purchase opportunity or more negative?

One Detailed analysis post In X, Martinez explains that Ethereum fell 57% from the $ 4,100 local summit in December. This decline has been associated with a widespread distribution of great Ethereum owners, especially whales. Over the last four months, the wallets that hold 10,000 ETH decreased by 80. Meanwhile, ETH whales, ie the wallets that hold 100,000 ETH and above, evacuated 130,000 ETH during this period.

During the decline of ETH, Ethereum Spot ETFs also experienced great withdrawal processes last month with a net output of $ 760 million. In addition, investors transferred 100,000 ETH to investors with intention of selling price loss.

When we look forward, Martinez says that several technical indicators are also a disadvantage for Ethereum in the midst of this intense sales pressure. For example, casting from an increasing triangle in 3 -day graphics shows that ETH can turn to a price target of approximately $ 1,000.

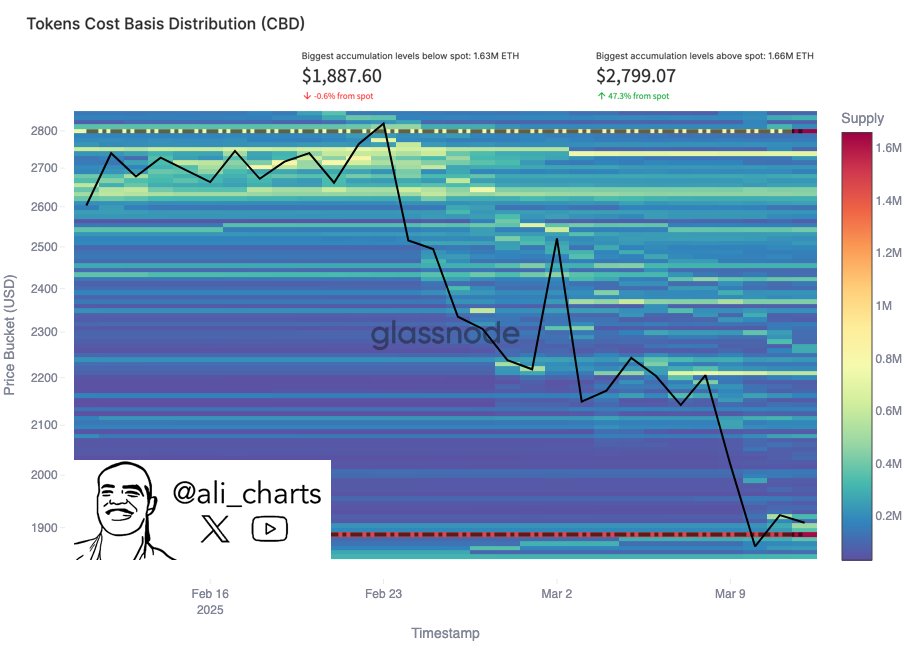

In the meantime, ETH Pricing Bands emphasized $ 1.440, another disadvantage target has decreased by 27.4% of the current market prices. Interestingly, the data obtained from the distribution on the cost of the cost is now related to both decrease projections, as Ethereum is currently above the basic support of $ 1,887. However, a price falling below this level will cause a lower decrease of targets such as $ 1,440, $ 1250 and $ 1,000.

Nevertheless, Martinez states that an ETH market has the potential for recovery. Analyst, analyzing the amount of ETH acquired at every price level, ETH Bulls says that it is faced with serious resistance between $ 2,250-2,610. If ETH Bulls can exceed this resistance, the current decrease invalidates the market appearance.

Ethereum Price Overview

During the writing, Ethereum was traded at $ 1.985, which reflected the earnings of 1.10% and 2.10% in the last seven days. However, Altcoin decreased by 27.32% last month. Ethereum, the largest altcoin on the market, has a market value of $ 239 billion representing 8.7% of the total crypto market.

The prominent picture from Ledger Insights, TradingView Graphics

Editorial process Bitcoinist has been thoroughly investigated and focused on providing accurate and impartial content. We maintain solid welding standards and each page is subject to an diligent examination by our best technology experts and experienced editors team. This process provides the integrity, relevance and value of our content for our readers.