Pengu and Pnut still decrease after the Robinhood list

Breast coins struggled to gain acceleration despite the last list of Pengu and Pnut in Robinhood. While these coins were expected to fluctuate, price actions were suppressed by reflecting wider skepticism in the market, especially around breast coins.

However, RSI levels show more growth if the procurement pressure increases and if the breast mine improves the sensitivity heals. If the momentum heals, both pengu and PNUT may test the key resistance levels and can potentially reverse their latest distractions.

Pengu is traded at the lowest levels of all time

Pengu, a NFT coin in Solana, has lost about 80% of its value in the last two months, and its market value is currently $ 400 million.

Today’s Robinhood list has seen the coin fluctuation by 6%, but technical indicators show that it still disappears for a strong healing.

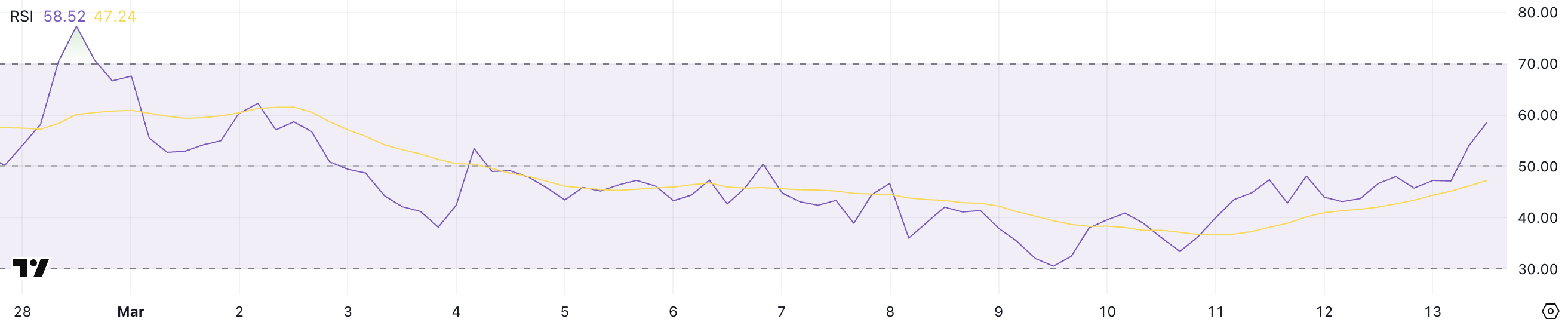

RSI rose from 25 to 55 in just four days, which showed the increasing purchase interest.

However, even on the list, Pengu has not yet seen a major rally because the breast coins and NFT coins have been faced with skepticism in the current market.

Pengu’s EMA lines still show a tendency to decline, but the upward movement in short -term absorptions shows a possible change.

If the momentum occurs, it may test the coin resistance at $ 0.0069 and open the door for a movement to $ 0.0075 and $ 0.0093 and may be over $ 0.0090 for the first time since March 2.

However, if the decline tendency persists and the penger support loses $ 0.0059, selling pressure may be low to $ 0.0050 and may indicate new low levels.

Pnut is currently trying to get a improvement in the last few days

In the last 15 days, Pnut has fallen 35% and has been one of the breast money that has been fighting in recent months. However, RSI is constantly rising by jumping from 33.4 from March 10 to 58.5.

This change shows that purchasing pressure increases and potentially points to a short -term recovery. If the RSI continues to rise and exceeds 60, it can strengthen the sense of ascension and push Pnut towards the key resistance levels.

Despite this momentum, PNUT’s EMA lines still propose a decrease tendency, as short -term EMAs are under long -term ones. However, short -term lines are reversed by moving upwards and reversing.

If this emas creates a golden cross, it can gain enough power to test the PNUT resistance from $ 0.211. A fracture above this level can earn more with the next targets with $ 0.25 and potentially $ 0.309.

If the disadvantage does not hold the existing rise train, PNUT may encounter a renewed sales pressure. The main level of support to be followed is $ 0.144, which has previously previous price decreases.

If this level disappears, PNUT may drop to $ 0.133 by marking new bastards and strengthening the fall structure.

Disclaimer

In line with the trust project instructions, this price analysis article is only for information purposes and should not be accepted as financial or investment advice. Beincrypto is determined to be correct, impartial reporting, but market conditions may change without notification. Always do your own research before making any financial decision and consult a specialist. Please note that our provisions and conditions, our Privacy Policy and our waiver are updated.